accumulated earnings tax irs

IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or. 1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3.

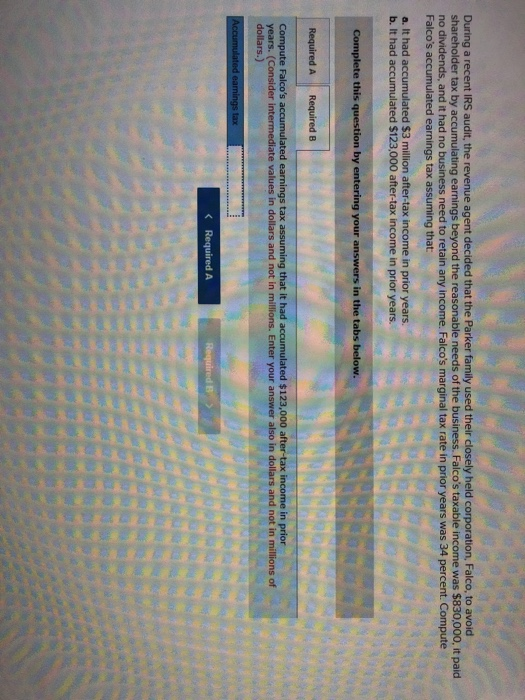

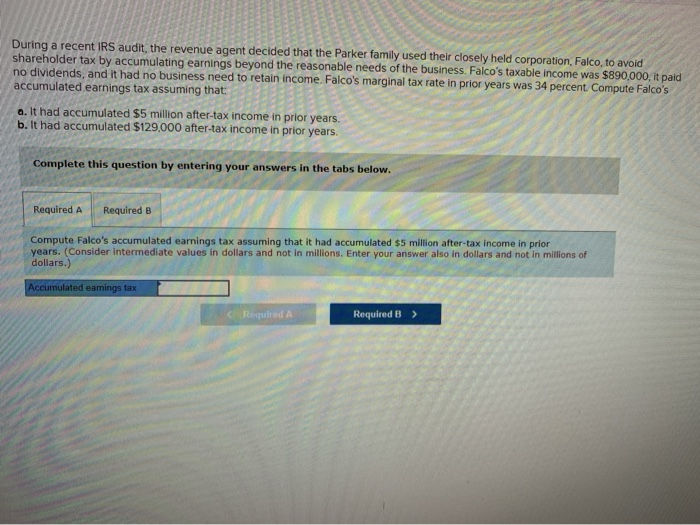

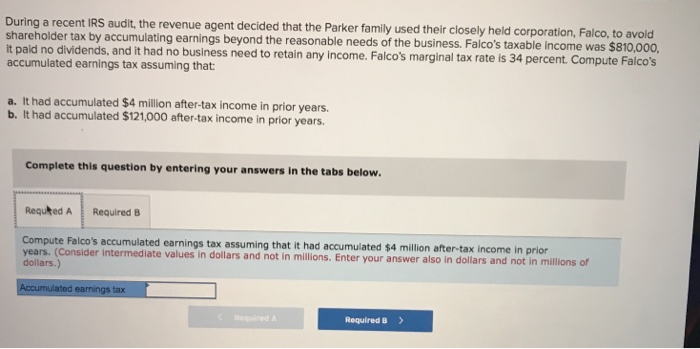

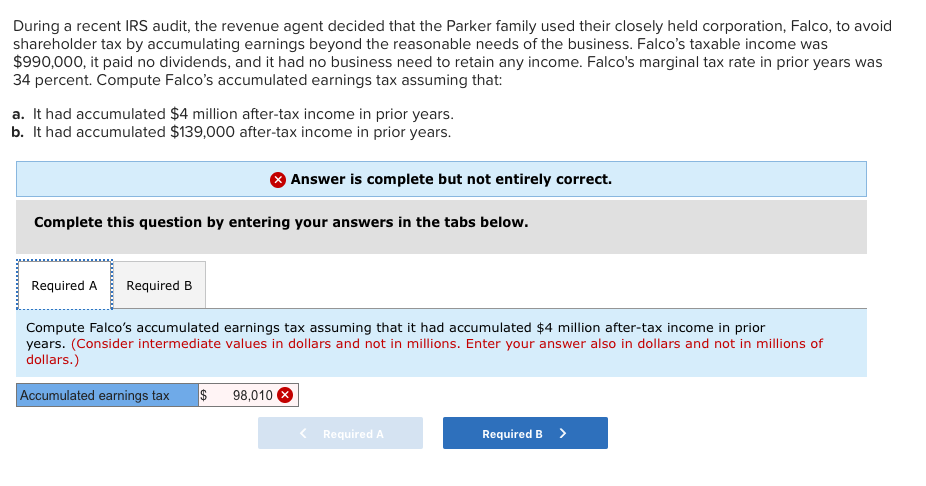

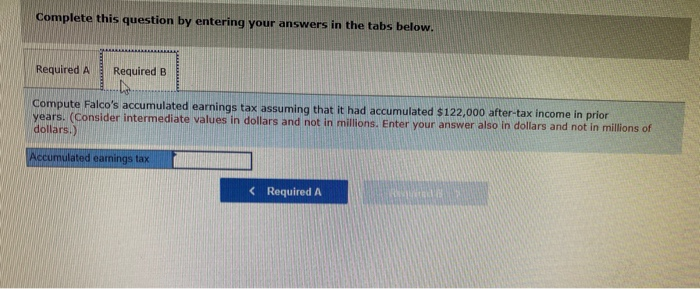

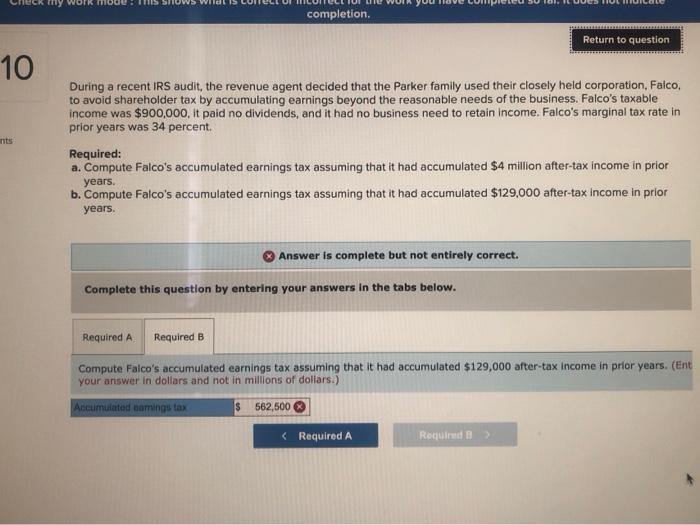

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

When the revenues or profits are above this level the firm.

. Add the result to the total tax liability before the refundable credits on your income tax return. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

However if a corporation allows earnings to accumulate. If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business. It compensates for taxes which.

He accumulated earnings tax AET is imposed by Internal Revenue Code IRC section 531 on C corporations formed or availed of for the purpose of avoiding the imposi. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. What is the Accumulated Earnings Tax.

Internal Revenue Service IRS sets the accumulated earnings tax scheme to prevent companies from excessively accumulating their. In addition to other taxes imposed by this chapter there is hereby imposed for each taxable year on the accumulated taxable. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company.

Exemption levels in the amounts of 250000 and 150000 depending on the company exist. Keep in mind that this is not a self-imposed tax. There is a certain level in which the number of earnings of C corporations can get.

When deferred compensation plans are used by closely held corporations and are maintained. The accumulated earnings credit allowable under section 535 c 1 on the basis of the reasonable needs of the business is determined to be only 20000. The accumulated earnings tax can be a hidden penalty tax on highly profitable corporations that allow their earnings to accumulate without paying adequate or any.

C corporations can earn up to 250000 without incurring accumulated. The base for the accumulated earnings penalty is accumulated taxable income. The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a much higher scheduled rate of.

An IRS review of a business can impose it. A corporation determines this amount by adjusting its taxable income for economic items to. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes.

The IRS also allows certain. Accumulated Earnings Tax. Breaking Down Accumulated Earnings Tax.

Write From Form 4970 and the amount of the tax to the left of the line 8 entry space. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. The tax rate on accumulated earnings is 20 the maximum rate at which they would.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the. Incurring accumulated earnings tax on capital for deferred compensation funding. The accumulated earnings tax rate is 20.

Accumulated Earnings Tax Details. Code 531 - Imposition of accumulated earnings tax.

Earnings And Profits Computation Case Study

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Answered During A Recent Irs Audit The Revenue Bartleby

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Solved Determine Whether The Following Statements About The Chegg Com

Demystifying Irc Section 965 Math The Cpa Journal

Solved Completion Return To Question 10 During A Recent Irs Chegg Com

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax